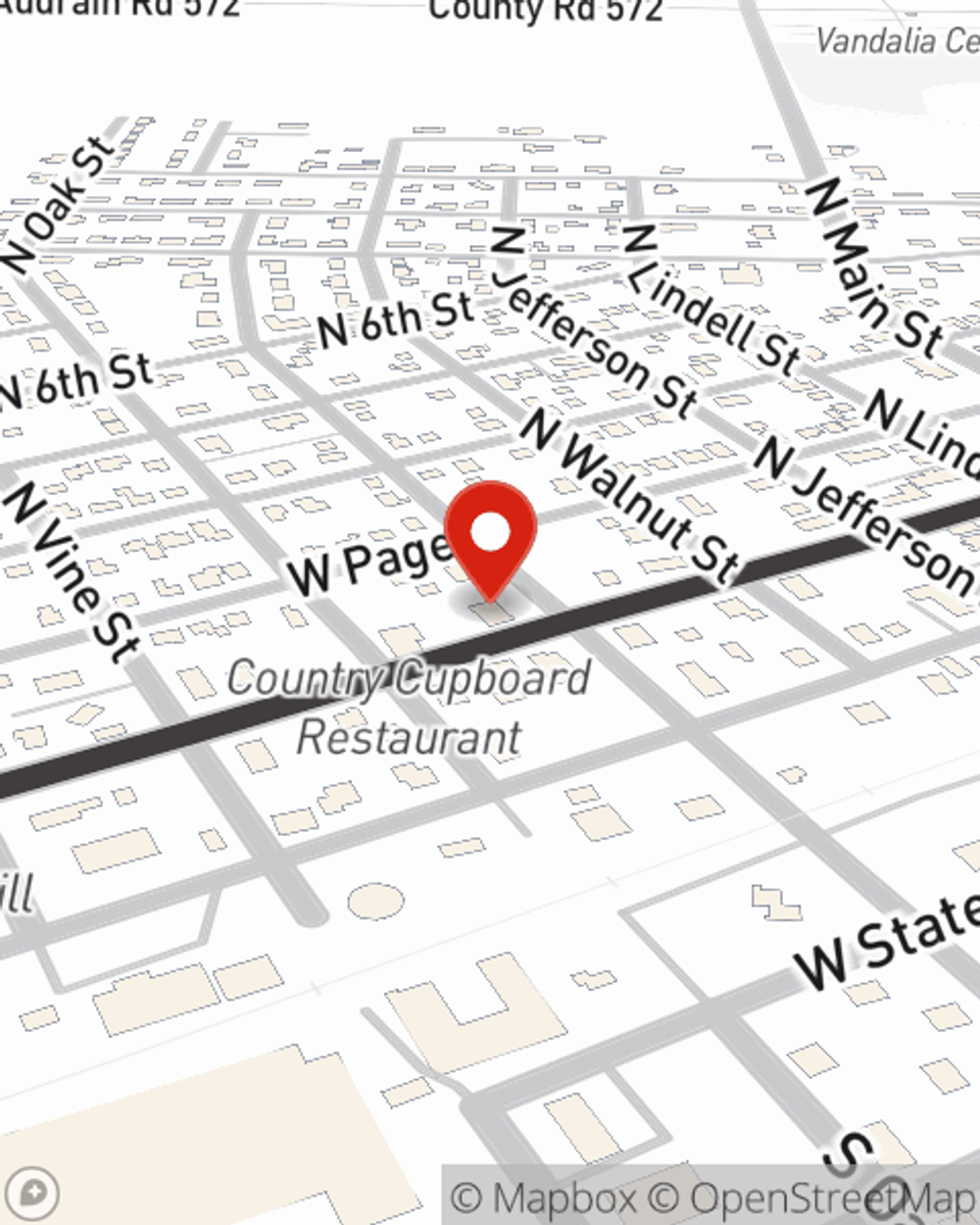

Business Insurance in and around Vandalia

Vandalia! Look no further for small business insurance.

Cover all the bases for your small business

Business Insurance At A Great Value!

Being a business owner is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, business continuity plans and extra liability coverage.

Vandalia! Look no further for small business insurance.

Cover all the bases for your small business

Keep Your Business Secure

Your company is unique. It's where you earn a living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just earning a paycheck or a store. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a psychologist. State Farm agent Ramsey Dickerman is ready to help review coverages that fit your business needs. Whether you are a barber, an HVAC contractor or an optician, or your business is a pet store, a shoe store or an ice cream shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Ramsey Dickerman understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Ramsey Dickerman today, and let's get down to business.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Ramsey Dickerman

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.